Dollar index trading at 89.54 (-0.51%)

Strength meter (today so far) – Aussie +0.84%, Kiwi +1.07%, Loonie +0.70%

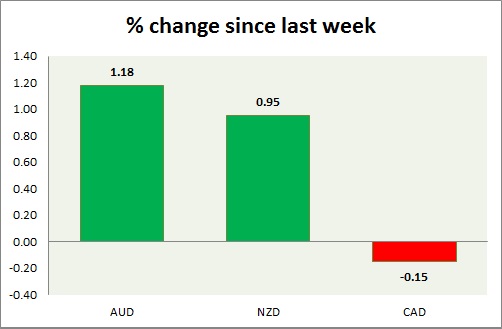

Strength meter (since last week) – Aussie +1.18%, Kiwi +0.95%, Loonie -0.15%

AUD/USD –

Trading at 0.782

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.765, Short term – 0.765

Resistance –

- Long term – 0.85, Medium term – 0.825, Short term – 0.8

Economic release today –

- Fourth quarter current account deficit came at $14 billion.

- RBA kept interest rates unchanged at 150 bps.

- Retail sales rose by 0.1 percent in January.

Commentary –

- Aussie is the best performer of the week as the dollar declines over trade war fear. Active call - Buy targeting 0.87

NZD/USD -

Trading at 0.73

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.68, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.76, Medium term – 0.735, Short term – 0.735

Economic release today –

- Global dairy auction is scheduled today.

Commentary –

- Kiwi is up on a weaker dollar, looking to gain and break key resistance area around 0.735

USD/CAD –

Trading at 1.29

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.2, Medium term – 1.22, Short term – 1.24

Resistance –

- Long term – 1.32, Medium term – 1.28, Short term – 1.28

Economic release today –

- IVEY PMI reports will be released at 15:00 GMT.

Commentary –

- Loonie is the worst performer of the week so far.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022