Dollar index trading at 90.10 (-0.08%)

Strength meter (today so far) – Aussie -0.08%, Kiwi +0.23%, Loonie -0.18%

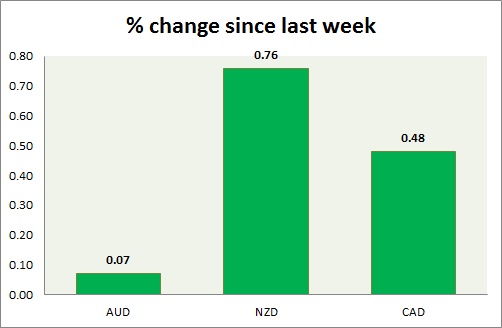

Strength meter (since last week) – Aussie +0.07%, Kiwi +0.76%, Loonie +0.48%

AUD/USD –

Trading at 0.767

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.765, Short term – 0.765

Resistance –

- Long term – 0.85, Medium term – 0.825, Short term – 0.8

Economic release today –

- Retail sales grew 0.6 percent in February.

- Building permits declined 6.2 percent in February, down 3.1 percent from a year ago.

- AiG services report will be released at 23:30 GMT.

Commentary –

- Aussie is marginally higher this week as the dollar recovers. Active call - Buy targeting 0.87

NZD/USD -

Trading at 0.728

Trend meter 6

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.68, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.76, Medium term – 0.735, Short term – 0.735

Economic release today –

- NIL

Commentary –

- Kiwi recovered from earlier loss despite a strong dollar and now the best performer of the week.

USD/CAD –

Trading at 1.283

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.22, Medium term – 1.24, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.3, Short term – 1.3

Economic release today –

- NIL

Commentary –

- Loonie is up this week over NAFTA hope.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX