Dollar index trading at 96.63 (-0.19%)

Strength meter (today so far) – Aussie +0.64%, Kiwi +0.78%, Loonie +0.16%

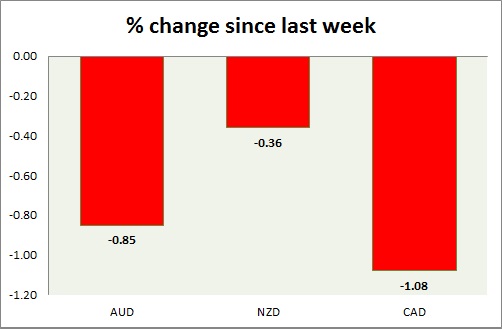

Strength meter (since last week) – Aussie -0.85%, Kiwi -0.36%, Loonie -1.08%

AUD/USD –

Trading at 0.726

Trend meter –

- Long term – Range/Sell, Medium term – sell, Short term – Range/buy

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.79 Medium term – 0.75, Short term – 0.732 (testing)

Economic release today –

- NIL

Commentary –

- The Australian dollar is giving up gains this week after a big rise over the last two weeks.

NZD/USD -

Trading at 0.684

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.66

Resistance –

- Long term – 0.735, Medium term – 0.72, Short term – 0.69

Economic release today –

- Global dairy price index declined by 3.5 percent at today’s auction.

Commentary –

- The New Zealand dollar is the best performer of the week but still down against the USD. Active Call - Sell kiwi targeting 0.59 area.

USD/CAD –

Trading at 1.329

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.29

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32 (broken)

Economic release today –

- NIL

Commentary –

- Loonie remains downbeat as lower oil price weigh. The worst performer of the week among commodity pairs. Active Call - Sell USD/CAD at 1.314 targeting 1.25 area.