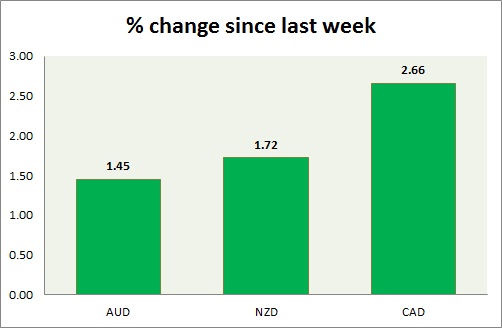

Commodity pairs (AUD, NZD, & CAD) gained against dollar but failed to break important levels and retraced gains. A chart and table is attached for explanation.

- Aussie traded as high as 0.784 in post FOMC rally but retraced back sharply. Aussie is currently trading at 0.765. Immediate Support lies at 0.757, 0.749 & Resistance 0.782, 0.79.

- Kiwi similarly traded as high as 0.754 just short of key resistance level. GDP for fourth quarter grew by 0.8% compared to previous 0.9%. Kiwi failed to extract much gain out of positive GDP data and retraced sharply. Pair is currently trading at 0.74; further losses might be on card but pair might test the resistance at 0.79 on the upside. Immediate Support lies at 0.726, 0.717 & Resistance 0.754, 0.762, 0.792.

- Canadian dollar is the worst performer of the week and continue to lose ground post FOMC rally. Pair traded close to 1.245 but gave up gains at key support. The pair is currently trading at 1.273. Immediate Support lies at 1.24 & Resistance 1.284.

|

AUD |

0.35% |

|

NZD |

1.12% |

|

CAD |

0.23% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand