Dollar index trading at 98.15 (-0.22%).

Strength meter (today so far) - Aussie -0.04%, Kiwi -0.12%, Loonie +15%.

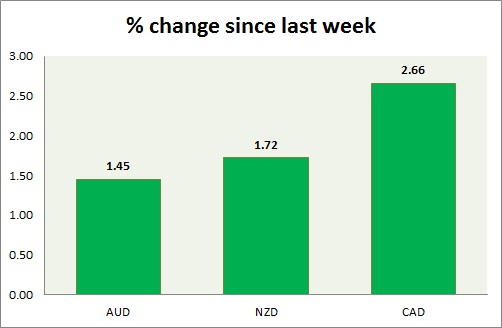

Strength meter (since last week) - Aussie -1.59%, Kiwi -1.61%, Loonie -0.33%.

AUD/USD -

Trading at 0.762

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.775-0.778

Economic release today -

- Building permits in February decresed -3.2% m/m, however up 14.2% y/y.

Commentary -

- Aussie struggling to keep gains above 0.76 level, however it bounced back from short term support area.

- Inverted hammer appeared in weekly chart. Bias remains downwards.

NZD/USD -

Trading at 0.744

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Sell/Range

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.757-0.76

Economic release today -

- NIL

Commentary -

- Pair is struggling to keep head above 0.745, however it successfully bounced back from rising trend line support area.

- Very bearish with long upper shadow appeared in week chart. Very close to a grave stone doji. Bias downwards.

USD/CAD -

Trading at 1.265

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.247-1.245. Immediate - 1.254-1.251

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.284

Economic release today -

- RBC manufacturing PMI for March came at 48.9, still negative but higher than previous 48.7

Commentary -

- Canadian dollar is top performer today and this week so far.

- Loonie dropped towards 1.27 against dollar around the same time with other pairs from broad based US dollar strength. Pair traded low around 1.263 after weaker economic release from US.

- Scope of a full scale breakout above looks limited without a catalyst as NFP looms ahead in the week.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate