Dollar index trading at 95.68 (0.11%)

Strength meter (today so far) – Aussie +0.12%, Kiwi -0.32%, Loonie +0.28%

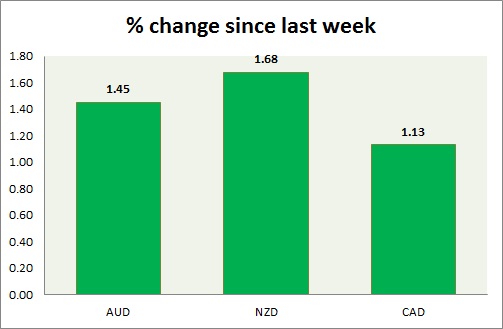

Strength meter (since last week) – Aussie +1.45%, Kiwi +1.68%, Loonie +1.13%

AUD/USD –

Trading at 0.772

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Consumer inflation expectations declined to 3.5 percent in August.

Commentary –

- Aussie is the best performer for the week. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.723

Trend meter –

- Long term – Sell, Medium term – Range, Short term – range

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Business PMI will be released at 22:30 GMT.

- Retail sales for the second quarter will be released at 22:45 GMT.

Commentary –

- New Zealand dollar rose as RBNZ failed to surprise the market and proved to be less aggressive.

USD/CAD –

Trading at 1.305

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.34, Medium term – 1.325, Short term – 1.325

Economic release today –

- New house prices grew 2.5 percent in June.

Commentary –

- Canadian dollar performed well after the bounce back of oil. But oil is likely to decline further and that could pull the trigger.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022