Dollar index trading at 94.87 (+0.08%)

Strength meter (today so far) – Aussie +0.09%, Kiwi +0.13%, Loonie +0.16%

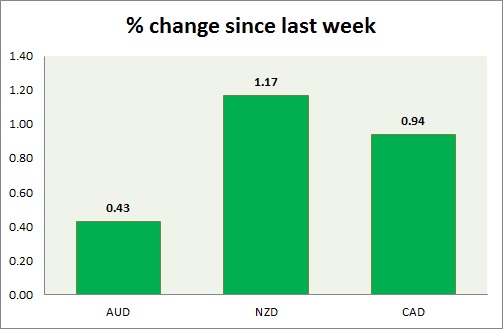

Strength meter (since last week) – Aussie +0.43%, Kiwi +1.17%, Loonie +0.94%

AUD/USD –

Trading at 0.767

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range/Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Unemployment rate declined to 5.7 percent. Part time employment rose by 71,600 and permanent employment declined by 45,400.

Commentary –

- Australian dollar failed this week to break a key resistance. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.727

Trend meter –

- Long term – Sell, Medium term – Range, Short term – range/Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- NIL.

Commentary –

- New Zealand dollar failed again this week at key resistance around 0.73 area. Further testing likely.

USD/CAD –

Trading at 1.282

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.34, Medium term – 1.325, Short term – 1.325

Economic release today –

- NIL

Commentary –

- The Canadian dollar remains buoyed this week thanks to the rebounding oil price.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022