Dollar index trading at 95.54 (+018%)

Strength meter (today so far) – Aussie -0.36%, Kiwi -0.80%, Loonie -0.27%

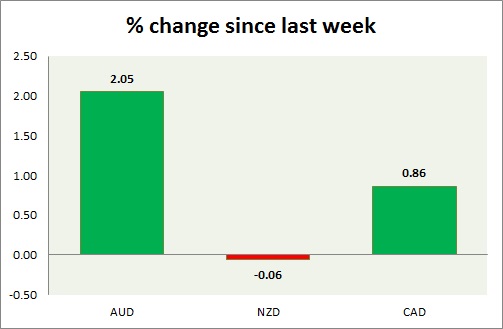

Strength meter (since last week) – Aussie +2.05%, Kiwi -0.06%, Loonie +0.86%

AUD/USD –

Trading at 0.762

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- NIL

Commentary –

- The Australian dollar scaled back some of its gains, yet up more than 2 percent this week. Key resistance area is still intact Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.725

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- NIL

Commentary –

- The kiwi is the worst performer this week, it suffered yet another fail at key resistance. The dovish comments from RBNZ has started to weigh We expect kiwi to rise towards 0.81 area.

USD/CAD –

Trading at 1.308

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.34, Medium term – 1.325, Short term – 1.325

Economic release today –

- Retail sales for July will be reported at 12:30 GMT, along with inflation figures for August.

Commentary –

- The Canadian dollar gave up some of the gains as the dollar recovered.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX