Dollar index trading at 95.39 (+0.18%).

Strength meter (today so far) - Aussie +0.08%, Kiwi +0.24%, Loonie +0.45%.

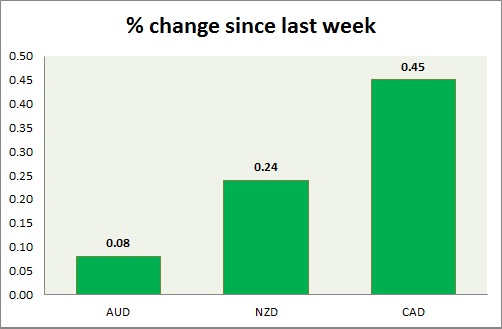

Strength meter (since last week) - Aussie +0.08%, Kiwi +0.24%, Loonie +0.45%.

AUD/USD -

Trading at 0.784

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80

Economic release today -

- Building permits grew 23.6% in March from a year ago and 2.8% m/m.

Commentary -

- Aussie puts a bearish inverted hammer candle after price failed to break above 0.80 resistance area last week. Focus is now on tomorrow's RBA meeting. Weak PMI data from China is posing headwinds.

NZD/USD -

Trading at 0.754

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772

Economic release today -

- NIL

Commentary -

- Kiwi's is lagging other currencies since dovish comments from RBNZ. Bias remains on the downside, however weak dollar might hinder downward move.

USD/CAD -

Trading at 1.212

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Sell

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.205-1.20

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.235-1.241, Immediate - 1.225-1.228

Economic release today -

- NIL

Commentary -

- Loonie reached initial target beyond 1.20 level last week, however loonie bulls are struggling since then along with crude. Pair might move further towards 1.18-1.17 area. However important supports are present in the area.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate