Dollar index trading at 93.88 (-0.73%).

Strength meter (today so far) - Aussie +1.54%, Kiwi +1.06%, Loonie +0.57%.

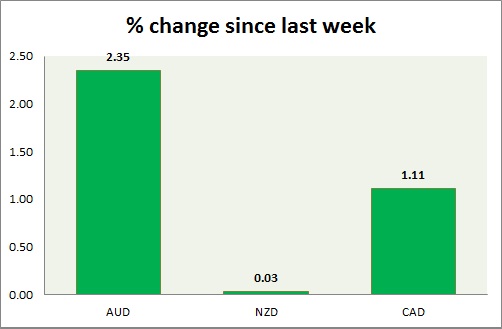

Strength meter (since last week) - Aussie +2.35%, Kiwi +0.03%, Loonie +1.11%.

AUD/USD -

Trading at 0.811

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Buy support/buy breakout

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75, Immediate - 0.786-0.784

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80 (broken)

Economic release today -

- Wages rose at 2.3% y/y in first quarter and 0.5% on quarterly basis.

Commentary -

- Aussie bulls have taken out resistance at 0.80 area with dollar weakening across board. Further rise is likely with initial target around 0.825-0.83 and 0.85 as second target.

NZD/USD -

Trading at 0.749

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.748-0.752

Economic release today -

- Business PMI to be released at 22:30 GMT.

- Retail sales to be released at 22:45 GMT.

Commentary -

- Kiwi has gained amid weaker dollar. Price now stands close to resistance area.

USD/CAD -

Trading at 1.194

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Sell

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.20-1.196 (broken)

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.235-1.241, Immediate - 1.225-1.228

Economic release today -

- NIL

Commentary -

- Canadian dollar gained further grounds, breaking the short term support as dollar fell post retail sales and crude made advance.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary