Dollar index trading at 93.97 (+0.80%).

Strength meter (today so far) - Aussie -0.47%, Kiwi -1.05%, Loonie -1.01%.

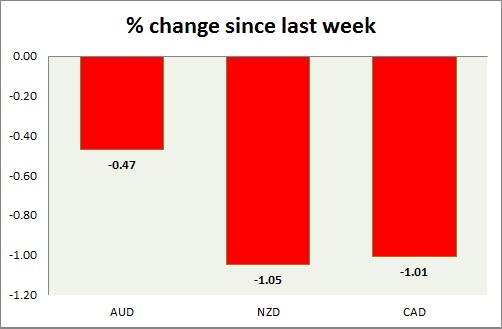

Strength meter (since last week) - Aussie -0.47%, Kiwi -1.05%, Loonie -1.01%.

AUD/USD -

Trading at 0.799

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Buy support/buy breakout

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75, Immediate - 0.786-0.784

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.83

Economic release today -

- New motor vehicle sales dropped by -1.5% in April, however up 2.8% from a year ago.

Commentary -

- Aussie lost grounds as iron prices resumed downtrend and dollar strengthen broad based. Aussie is most likely to move upwards. Signs are not enough to say that downtrend has resumed.

NZD/USD -

Trading at 0.738

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.748-0.752

Economic release today -

- NIL

Commentary -

- Kiwi is back at support after bulls were halted at falling trend line as expected. Kiwi bears would find it difficult to break the resistance area without any key event namely RBNZ rate decision.

USD/CAD -

Trading at 1.213

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Sell

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.19

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.235-1.241, Immediate - 1.225-1.228

Economic release today -

- NIL

Commentary -

- Canadian dollar bulls gave up after another failed attempt to break 1.19 support area. Downside remains limited for the pair. Weaker oil price might move the pair higher to test resistance.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand