Dollar index trading at 95.37 (-0.23%).

Strength meter (today so far) - Aussie -0.02%, Kiwi +0.10%, Loonie -0.08%.

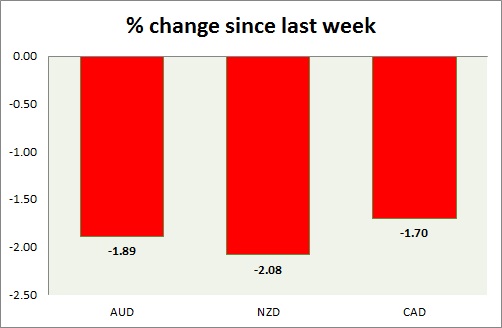

Strength meter (since last week) - Aussie -1.89%, Kiwi -2.08%, Loonie -1.70%.

AUD/USD -

Trading at 0.787

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75, Immediate - 0.786-0.784

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.83

Economic release today -

- Inflation expectation for May rose to 3.6% from 3.4% prior.

Commentary -

- Aussie is consolidating at key support. Bounce back is very much likely at this point, however stronger dollar is posing headwinds for such.

NZD/USD -

Trading at 0.73

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.72

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.748-0.752

Economic release today -

- NIL

Commentary -

- Kiwi is consolidating at 0.73 area. Selling the rallies remain key strategy. Further downside remains open.

USD/CAD -

Trading at 1.222

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Buy Support

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.19

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.235-1.241, Immediate - 1.225-1.228

Economic release today -

- NIL

Commentary -

- Canadian dollar is the best performer this week so far, pair might rise further if crude price breaks below.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary