Dollar index trading at 99.96 (-0.36%)

Strength meter (today so far) – Aussie +0.15%, Kiwi +0.28%, Loonie +0.28%

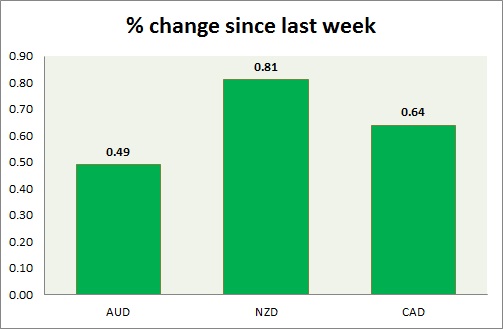

Strength meter (since last week) – Aussie +0.49%, Kiwi +0.81%, Loonie +0.64%

AUD/USD –

Trading at 0.758

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Private sector credit rose 5.6 percent y/y.

- M3 money supply rose 6.3 percent y/y.

Commentary –

- The Aussie has now started gaining further against the dollar as the commodity prices remain supportive.

NZD/USD –

Trading at 0.731

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Unemployment report for fourth quarter will be published at 21:45 GMT.

Commentary –

- Kiwi is focused on the Dollar’s strength and RBNZ outlook. It is the best performer this week so far as the dollar weakens.

USD/CAD –

Trading at 1.307

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- Raw material price index for December will be published at 13:30 GMT, along with Industrioal product price and December GDP.

Commentary –

- Loonie is higher on weaker dollar and higher oil price. We expect the loonie to reach 1.375 and 1.4.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022