Dollar index trading at 99.34 (-0.35%)

Strength meter (today so far) – Aussie +1.15%, Kiwi +0.54%, Loonie +0.39%

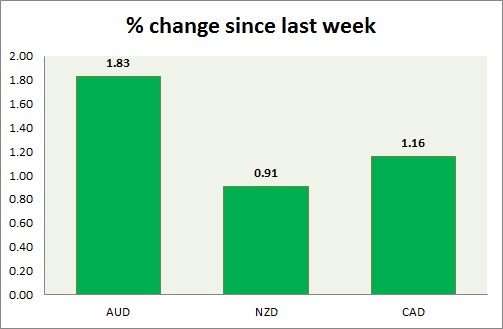

Strength meter (since last week) – Aussie +1.83%, Kiwi +0.91%, Loonie +1.16%

AUD/USD –

Trading at 0.768

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Building permits declined 11.4 percent in December.

- Trade balance came at 3.511 billion as exports rise 5 percent in December and imports rise by 1 percent.

Commentary –

- The Aussie is the best performer against the dollar as the commodity prices rise and the dollar weakens. Strong trade balance provided necessary support.

NZD/USD –

Trading at 0.732

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.733

Economic release today –

- NIL

Commentary –

- Kiwi is back testing key resistance area around 0.733.

USD/CAD –

Trading at 1.3

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.28, Medium term – 1.3 , Short term – 1.3

Resistance –

- Long term – 1.38, Medium term – 1.365, Short term – 1.365

Economic release today –

- RBC manufacturing PMI report will be published at 14:30 GMT.

Commentary –

- Loonie is threatening to break key resistance at 1.3.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed