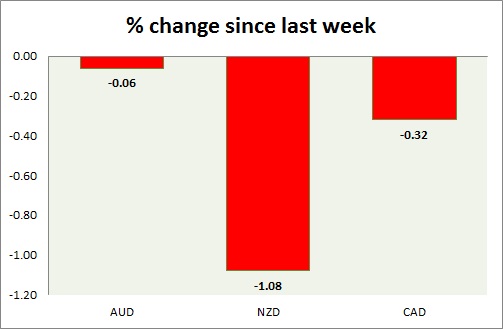

Commodity pairs (AUD, NZD, & CAD) are tracking back their gains after better data were released from US namely durable goods at 2.8% and real weekly earnings at 1.3%. They still fared well compared to Euro & Franc. A chart and table is attached for explanation.

- Aussie was trying to break above its resistance of 0.792 but failed so far. The private capital expenditure data released today showed contraction of 2.2% worse than expected. The currency is expected to remain depressed amid a slowing Chinese economy. The pair is trading at 0.784. Immediate Support lies at 0.767 & Resistance 0.792.

- Kiwi is the best performer, struggling hard in the face of better data from US and disappointing trade balance that showed gap increased to $ -1.41 billion YoY. Nevertheless Kiwi has broken above the range of 0.74 and decisively maintaining above the level. It may perform well against other counterparts like Euro, Yen, and Aussie. Pair is trading at 0.756. Immediate Support lies at 0.742 & Resistance 0.762.

- Canadian dollar losing ground after the recent rally fuelled by comments of Governor Poloz. The outlook remains bearish in a falling rate environment. Today's CPI data was better than expected. Core CPI grew 2.2% YoY and headline fell -0.2% mom. This will keep the pair checked in the near term. The pair is currently trading at 1.247. Immediate Support lies at 1.235 & Resistance 1.272.

|

AUD |

0.08% |

|

NZD |

0.65% |

|

CAD |

0.52% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate