Dollar index trading at 96.68 (-0.13%)

Strength meter (today so far) - Aussie +0.82%, Kiwi +0.45%, Loonie +0.08%.

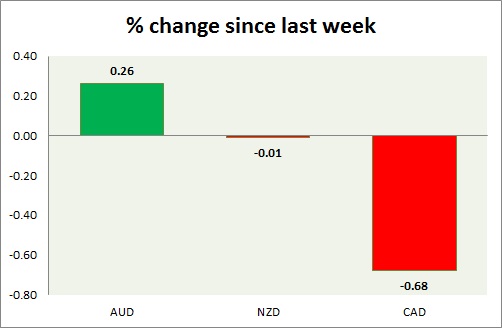

Strength meter (since last week) - Aussie +0.26%, Kiwi -0.01%, Loonie -0.68%.

AUD/USD -

Trading at 0.745

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796

Economic release today -

- Business condition rose to 11 from 8 whereas confidence grew to 10 from 6

Commentary -

- Aussie is the best performer today, as optimism rose in Australia. Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.671

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/sell resistance

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- NIL

Commentary -

- Kiwi is consolidating above 0.65 crucial support.

USD/CAD -

Trading at 1.273

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217-1.213

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28.

Economic release today -

- NIL

Commentary -

- Canadian dollar remains sell against dollar, the pair might reach as high as 1.38. Iran deal is weighing on loonie, however it got some support on the news that sanction are not immediately removed.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?