Dollar index trading at 96.97 (-0.02%)

Strength meter (today so far) – Aussie +0.52%, Kiwi +0.58%, Loonie +0.21%

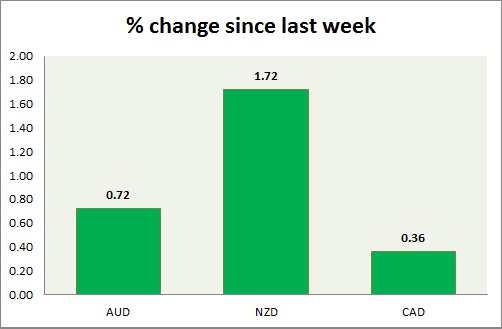

Strength meter (since last week) – Aussie +0.72%, Kiwi +1.72%, Loonie +0.36%

AUD/USD –

Trading at 0.751

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.755

Economic release today –

- NIL

Commentary –

- Aussie testing 0.75 barriers; performance improved with rising commodity prices. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.704

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.67, Short term – 0.67

Resistance –

- Long term – 0.76, Medium term – 0.73, Short term – 0.723

Economic release today –

- April trade balance report will be released at 22:45 GMT.

Commentary –

- The weaker dollar and higher commodity prices pushing the kiwi higher; the best performer of the week so far.

USD/CAD –

Trading at 1.346

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.32, Medium term – 1.33, Short term – 1.35

Resistance –

- Long term – 1.38, Medium term – 1.38, Short term – 1.38

Economic release today –

- Wholesale sales grew by 0.9 percent in March.

Commentary –

- Loonie remains upbeat ahead of OPEC meeting on Thursday on higher oil price.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed