Dollar index trading at 96.91 (+0.16%)

Strength meter (today so far) – Aussie +0.50%, Kiwi -0.06%, Loonie -0.05%

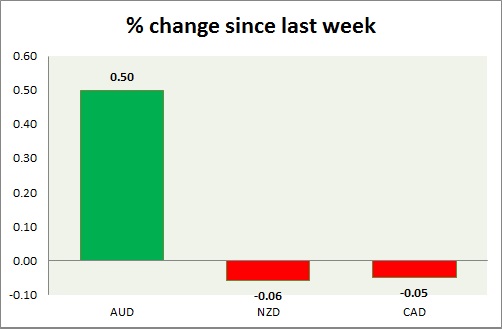

Strength meter (since last week) – Aussie +0.50%, Kiwi -0.06%, Loonie -0.05%

AUD/USD –

Trading at 0.747

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.755

Economic release today –

- TD Securities inflation 2.8 percent y/y in May.

- Company gross operating profits grew 6 percent q/q in the first quarter.

Commentary –

- The Australian dollar is the best performer of the day. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.713

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.67, Short term – 0.67

Resistance –

- Long term – 0.76, Medium term – 0.73, Short term – 0.723

Economic release today –

- NIL.

Commentary –

- Kiwi is only marginally down this week.

USD/CAD –

Trading at 1.348

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.32, Medium term – 1.33, Short term – 1.35 (testing)

Resistance –

- Long term – 1.38, Medium term – 1.38, Short term – 1.37

Economic release today –

- NIL

Commentary –

- Loonie is likely to move in line with oil price.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022