Dollar index trading at 95.73 (+0.17%)

Strength meter (today so far) – Aussie -0.12%, Kiwi +0.22%, Loonie +0.13%

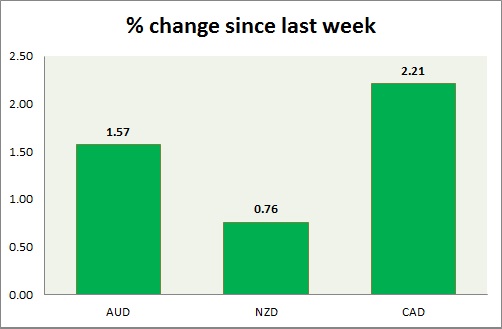

Strength meter (since last week) – Aussie +1.57%, Kiwi +0.76%, Loonie +2.21%

AUD/USD –

Trading at 0.768

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.716, Medium term – 0.735, Short term – 0.746

Resistance –

- Long term – 0.785, Medium term – 0.777, Short term – 0.765 (testing)

Economic release today –

- Private sector credit is up 5 percent in May from a year ago.

Commentary –

- Aussie is continuing its test of key resistance around 0.76 area. Strong iron ore price supporting Aussie. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.732

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.67, Medium term – 0.69, Short term – 0.71

Resistance –

- Long term – 0.76, Medium term – 0.73, Short term – 0.723 (broken)

Economic release today –

- NIL

Commentary –

- Kiwi is testing key resistance around 0.73 area. It is the worst performer of the week.

USD/CAD –

Trading at 1.298

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.3, Medium term – 1.3, Short term – 1.32 (broken)

Resistance –

- Long term – 1.38, Medium term – 1.37, Short term – 1.35

Economic release today –

- NIL

Commentary –

- Loonie is the best performer of the week, riding on rate hike speculations and recovering oil price. Rate hike may come as soon as July.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX