Dollar index trading at 95.98 (-0.17%)

Strength meter (today so far) - Aussie -0.63%, Kiwi +1.46%, Loonie +0.02%.

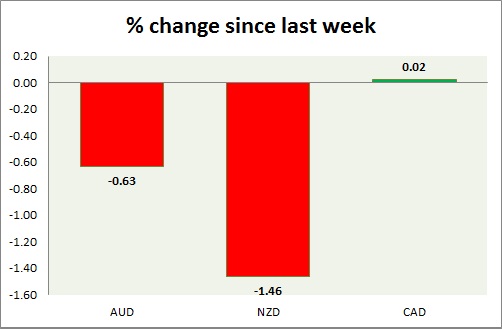

Strength meter (since last week) - Aussie -0.63%, Kiwi +1.46%, Loonie +0.02%.

AUD/USD -

Trading at 0.711

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.70, Short term - 0.70

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.74

Economic release today -

- TD securities inflation rose to 1.7% in August from a year ago.

- HIA new home sales dropped by -0.4% in July.

- Company gross operating profit dropped by -1.9% q/q in second quarter.

Commentary -

- Aussie is consolidating above 0.7 mark with downside bias. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.636

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 0.56, Medium term - 0.60, Short term - 0.60

Resistance -

- Long term - 0.78, Medium term - 0.75, Short term - 0.70, Immediate - 0.68

Economic release today -

- Terms of trade index to be released at 22:45 GMT.

- ANZ business confidence deteriorated to -29.1 in August, compared to -15.3 in July.

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Kiwi remains worst performer today.

USD/CAD -

Trading at 1.319

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.29

Resistance -

- Long term - 1.40(broken), Medium term - 1.35, Short term - 1.35

Economic release today -

- Current account balance came at -17.4 billion in second quarter, compared to -$18.15 billion in first.

Commentary -

- Loonie is the best performer today as oil price jumped back sharply for three consecutive days.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary