Dollar index trading at 93.57 (-0.03%)

Strength meter (today so far) – Aussie -0.10%, Kiwi +0.10%, Loonie -0.17%

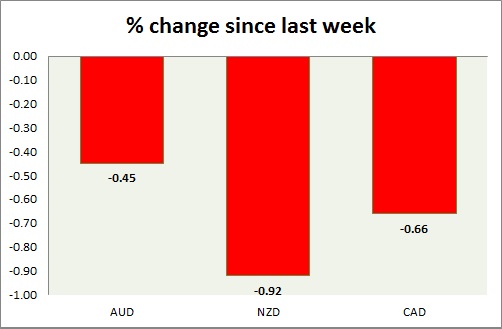

Strength meter (since last week) – Aussie -0.45%, Kiwi -0.92%, Loonie -0.66%

AUD/USD –

Trading at 0.789

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.746, Medium term – 0.765, Short term – 0.77

Resistance –

- Long term – 0.825, Medium term – 0.825, Short term – 0.8 (testing)

Economic release today –

- Westpac consumer confidence declined 1.5 percent in August. Home loans grew by 0.5 percent in June, while investment lending for homes grew by 1.6 percent.

Commentary –

- Aussie is enjoying a major breakout, likely to rise towards 0.82 against the dollar. It is flat this week as the dollar recovers. Further downside correction likely.

NZD/USD –

Trading at 0.733

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.69, Medium term – 0.71, Short term – 0.73

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.75

Economic release today –

- RBNZ will announce interest rate decision at 21:00 GMT.

Commentary –

- Kiwi pulls back ahead of RBNZ rate decision on Wednesday. Active call – Buy Kiwi targeting 0.825.

USD/CAD –

Trading at 1.269

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.22, Medium term – 1.235, Short term – 1.235

Resistance –

- Long term – 1.32, Medium term – 1.295, Short term – 1.28

Economic release today –

- Building permits increased by 2.5 percent in June and housing starts increased to 222,300.

Commentary –

- After weeks of outperformance, the loonie is the down this week on weaker oil price and recovering dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX