Dollar index trading at 92.58 (-0.12%)

Strength meter (today so far) – Aussie -0.09%, Kiwi +0.32%, Loonie -0.69%

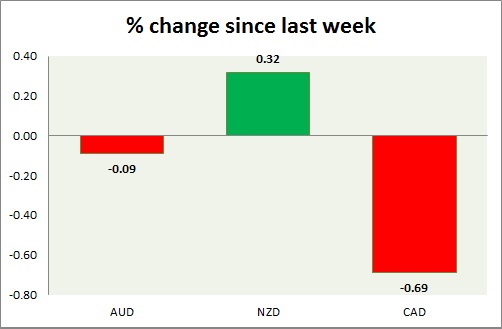

Strength meter (since last week) – Aussie -0.09%, Kiwi +0.32%, Loonie -0.69%

AUD/USD –

Trading at 0.795

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.746, Medium term – 0.765, Short term – 0.77

Resistance –

- Long term – 0.825, Medium term – 0.825, Short term – 0.8 (testing)

Economic release today –

- TD Securities inflation up 0.1 percent in August, up 2.6 percent from a year ago.

- Company gross operating profits down 4.5 percent q/q in Q2.

Commentary –

- Aussie is enjoying a major breakout, likely to rise towards 0.82 against the dollar. It is down as the dollar recovers; further downside correction likely.

NZD/USD –

Trading at 0.717

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.69, Medium term – 0.71, Short term – 0.71

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.75

Economic release today –

- NIL

Commentary –

- Kiwi is up today but lost grounds over past few weeks over RBNZ’s verbal stance against the kiwi. Active call – Buy Kiwi targeting 0.825.

USD/CAD –

Trading at 1.242

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.22, Medium term – 1.235, Short term – 1.235 (testing)

Resistance –

- Long term – 1.32, Medium term – 1.295, Short term – 1.28

Economic release today –

- NIL

Commentary –

- The loonie is the worst performer of the day.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX