Dollar index trading at 92.61 (-0.10%)

Strength meter (today so far) – Euro -0.06%, Franc -0.17%, Yen +0.25%, GBP -0.01%

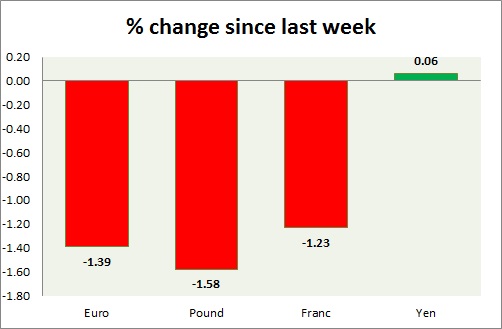

Strength meter (since last week) – Euro -1.39%, Franc -1.23%, Yen +0.06%, GBP -1.58%

EUR/USD –

Trading at 1.198

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.18, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.25, Medium term – 1.25, Short term – 1.25

Economic release today –

- Markit services PMI declined to 54.7 in April.

- Retail sales up 0.8 percent y/y in March.

Commentary –

- The euro is down this week as the dollar recovery continues. Active Call - Sell Euro at 1.218 with 1.17 as target

GBP/USD –

Trading at 1.357

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Sell

Support –

- Long term – 1.35, Medium term – 1.365, Short term – 1.365 (testing)

Resistance –

- Long term – 1.50 Medium term – 1.485, Short term – 1.435

Economic release today –

- NIL

Commentary –

- The pound is declining steadily as BoE governor Carney signaled slower pace of hikes and as GDP number disappointed and as strong dollar weighs. The worst performer of the week. Active call- short term sell targeting 1.375 (target reached); extended to 1.354

USD/JPY –

Trading at 108.8

Trend meter -

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 101, Medium term – 104.2, Short term – 106.2

Resistance –

- Long term – 111, Medium term – 109, Short term – 109 (testing)

Economic release today –

- NIL

Commentary –

- The yen recovered ground as stocks slide. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.997

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.92

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- NIL

Commentary –

- Franc is down in line with the euro this week.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX