Dollar index trading at 94.32 (-0.54%)

Strength meter (today so far) – Euro +0.78%, Franc +0.12%, Yen -0.40%, GBP +0.29%

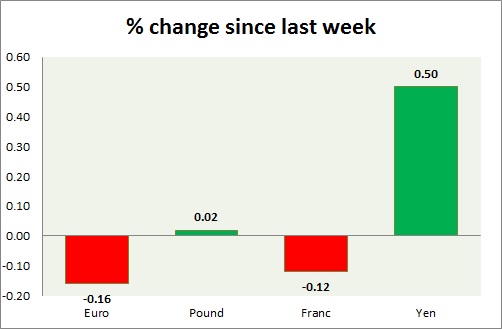

Strength meter (since last week) – Euro -0.16%, Franc -0.12%, Yen +0.50%, GBP +0.02%

EUR/USD –

Trading at 1.163

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Sell

Support

- Long term – 1.12, Medium term – 1.16, Short term – 1.16

Resistance –

- Long term – 1.25, Medium term – 1.22, Short term – 1.2

Economic release today –

- Services sentiment index rose to 14.3 in May.

- Consumer confidence index 0.2 in May.

- Industrial confidence at 6.8 in May.

- Economic sentiment index at 112.5

- Business climate at 1.45 in May.

Commentary –

- The euro recovered as the dollar declined from key resistance. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.14

GBP/USD –

Trading at 1.329

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.32, Medium term – 1.35, Short term – 1.35 (broken)

Resistance –

- Long term – 1.425 Medium term – 1.39, Short term – 1.37

Economic release today –

- GFK consumer confidence report will be released at 23:00 GMT.

Commentary –

- The pound is heading lower facing turmoil in Europe and a weak domestic economy. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.3

USD/JPY –

Trading at 108.8

Trend meter -

- Long term – Sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 101, Medium term – 104.2, Short term – 106.2

Resistance –

- Long term – 111, Medium term – 109, Short term – 109

Economic release today –

- Industrial production report will be released at 23:30 GMT.

Commentary –

- The yen is heading higher on risk aversion.

USD/CHF –

Trading at 0.989

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- KOF leading indicator declined to 100 in May.

- Zew survey index rose to 28 in May.

- SNB chairman Jordon is set for a speech at 14:45 GMT.

Commentary –

- Franc is the worst performer of the week so far.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed