Dollar index trading at 94.48 (-0.29%)

Strength meter (today so far) – Euro +0.35%, Franc +0.40%, Yen +0.06%, GBP +0.22%

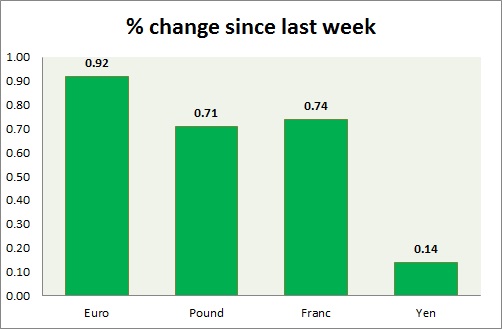

Strength meter (since last week) – Euro +0.92%, Franc +0.74%, Yen +0.14%, GBP +0.71%

EUR/USD –

Trading at 1.172

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Buy

Support

- Long term – 1.10, Medium term – 1.12, Short term – 1.15

Resistance –

- Long term – 1.22, Medium term – 1.18, Short term – 1.18

Economic release today –

- Private loans up 3 percent y/y in July.

- M3 money supply up 4.1 percent y/y in July.

Commentary –

- The euro is trying to grind higher as the dollar continues to retrace gains. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.095; Euro might correct towards 1.22 area

GBP/USD –

Trading at 1.292

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.19, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.35 Medium term – 1.32, Short term – 1.305

Economic release today –

- NIL

Commentary –

- The pound is continuing to recover as the dollar declines. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.25

USD/JPY –

Trading at 111.1

Trend meter -

- Long term – Sell, Medium term – buy, Short term – Range/Buy

Support –

- Long term – 104.2, Medium term – 106.2, Short term – 109.2

Resistance –

- Long term – 116, Medium term – 114, Short term – 112

Economic release today –

- NIL

Commentary –

- The yen remains trapped in bull/bear fight amid risk aversion and strong dollar. Up this week on a weaker dollar but the worst performer.

USD/CHF –

Trading at 0.975

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- Employment level at 5.048 million barrels per day.

Commentary –

- Franc is slightly worse performer this week.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX