Dollar index trading at 96.18 (-0.22%)

Strength meter (today so far) – Euro +0.61%, Franc +0.59%, Yen +0.12%, GBP +0.50%

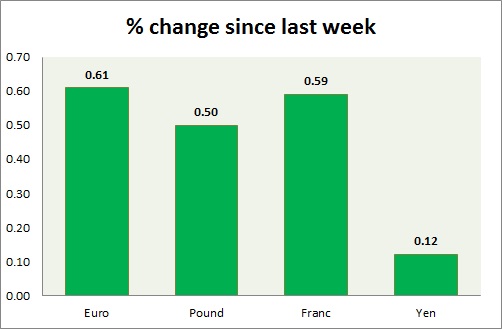

Strength meter (since last week) – Euro +0.61%, Franc +0.59%, Yen +0.12%, GBP +0.50%

EUR/USD –

Trading at 1.146

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Buy

Support

- Long term – 1.10, Medium term – 1.12, Short term – 1.123

Resistance –

- Long term – 1.22, Medium term – 1.18, Short term – 1.153

Economic release today –

- Sentix investor confidence declined to -1.5 in January.

- Retail sales rose 0.6 percent in November, up 1.1 percent from a year ago.

Commentary –

- The euro is heading higher to test key resistance around 1.15 area. Active Call - Sell Euro at 1.218 with 1.17 as target; target revised lower to 1.095 area.

GBP/USD –

Trading at 1.277

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Buy

Support –

- Long term – 1.23, Medium term – 1.25, Short term – 1.268

Resistance –

- Long term – 1.35 Medium term – 1.337, Short term – 1.326

Economic release today –

- NIL

Commentary –

- The pound is up on dollar’s weakness and as the shorts unwind. Active call- short term sell at 1.413 targeting 1.375 (target reached); extended to 1.354 (target reached); extended to 1.25 and 1.21

USD/JPY –

Trading at 108.3

Trend meter -

- Long term – Sell, Medium term – buy, Short term – Range/Sell

Support –

- Long term – 106.2, Medium term – 109.2, Short term – 111 (broken)

Resistance –

- Long term – 117, Medium term – 114, Short term – 114

Economic release today –

- NIL

Commentary –

- The yen is steadily weakening since the sharp rise of last week.

USD/CHF –

Trading at 0.98

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Buy

Support –

- Long term – 0.92, Medium term – 0.95, Short term – 0.97

Resistance –

- Long term – 1.03, Medium term – 1.00, Short term – 1.00

Economic release today –

- NIL

Commentary –

- Franc is up in line with the euro so far.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed