Dollar index trading at 97.86 (+0.50%).

Strength meter (today so far) - Euro -0.40%, Franc -0.37%, Yen -0.73%, GBP -0.50%

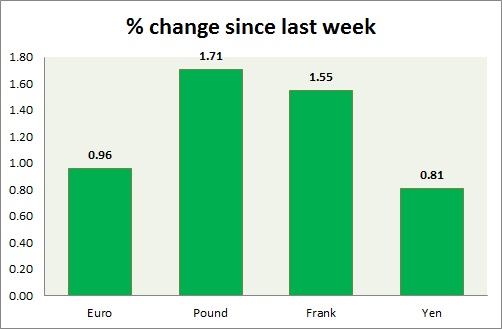

Strength meter (since last week) - Euro -0.40%, Franc -0.37%, Yen -0.73%, GBP -0.50%

EUR/USD -

Trading at 1.084

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Buy

Support -

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.077-1.075

Resistance -

- Long term - 1.1035-1.11, Medium term - 1.102-1.11, Short term - 1.102-1.105, Immediate - 1.092-1.095

Economic release today -

- Euro zone consumer confidence rose to -3.7 from prior -6.7

- Economic sentiment rose to 103.9 from prior 102.3

- Euro zone business climate jumped to 0.23 from prior 0.07

- Euro zone Industrial and services confidence improved to -2.9 and 6 from prior -4.7 and 5.3

- Spanish HICP came fell by -0.7% and German HICP grew by 0.5%

- Greek PPI fell by -4.8% compared to prior -9.6%

- Portugal business confidence improved to 0.6 and consumer confidence improved to -19.2 from prior 0.3 and -21.2

Commentary -

- Euro is facing selling pressure, as market is becoming cautious as time is narrowing on Greek resolution. Euro after making a high around 1.088 today, fell to 1.081.

GBP/USD -

Trading at 1.479

Trend meter -

- Long term - Range/Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.462-1.455, Short term - 1.475-1.472

Resistance -

- Long term - 1.553-1.56, Medium term - 1.516-1.52, Short term - 1.498-1.502, Immediate - 1.49-1.493

Economic release today -

- Mortgage approvals increased to 61.76K from prior 60.7K

- Consumer credit in February at £ 0.74 billion.

- Money supply M4 decreased by -3.2%.

- GFK consumer confidence will be released at 23:05 GMT.

Commentary -

- Pound remains weak as clarity lacks over policy direction at BOE as risks remain broadly balanced. Uncertainty over upcoming election pushing the pair to the lower bound of current range.

USD/JPY -

Trading at 119.9

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Sell

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.2-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122, Immediate - 120.8-121.1

Economic release today -

- Industrial production for February released over weekend, fell by -2.6% YoY.

Commentary -

- Pair remains range bound, as weaker dockets continue to pose doubts over economy and BOJ remains divided over policy moves.

USD/CHF -

Trading at 0.965

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Sell

Support -

- Long term - 0.88, Medium term - 0.937, Short term - 0.945

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.997, Immediate - 0.972-0.98

Economic release today -

- KOF leading indicator rose to 90.8 from prior 90.3.

Commentary -

- Franc is the best performer this week so far. Pair is probably going to test the resistance. Bias remains downward.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate