Dollar index trading at 97.41 (-0.51%).

Strength meter (today so far) - Euro +0.40%, Franc +0.54%, Yen +0.44%, GBP 1%

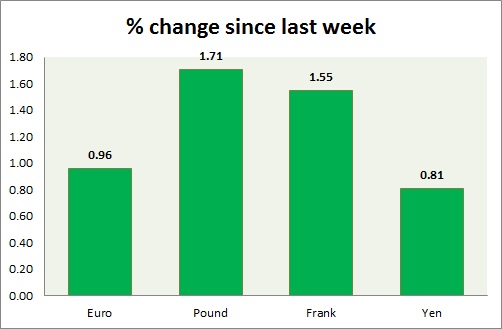

Strength meter (since last week) - Euro -0.89%, Franc -0.94%, Yen -0.69%, GBP +0.35%

EUR/USD -

Trading at 1.086

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.07-1.073

Resistance -

- Long term - 1.1035-1.11, Medium term - 1.102-1.11, Short term - 1.102-1.105

Economic release today -

- Euro zone retail sales grew 3% y/y in March, however dropped -0.2% m/m.

Commentary -

- Successful auction announcement failed to boost Euro, it continues to trade in range.

- Pair got support around 1.08, however failed to gain above 1.089 so far today.

GBP/USD -

Trading at 1.497

Trend meter -

- Long term - Range/Sell, Medium term - Sell, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.462-1.455, Short term - 1.475-1.472

Resistance -

- Long term - 1.553-1.56, Medium term - 1.516-1.52, Short term - 1.498-1.502

Economic release today -

- BOE published credit condition survey for 1st quarter 2015. Credit conditions remain broadly unchanged from last quarter survey.

Commentary -

- Pound is the best performer today and this week so far. Pair was pushed towards 1.48 yesterday, after its failed attempt to break 1.50.

- However pair has comeback in the region to test the level once again today.

USD/JPY -

Trading at 119.7

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.2-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122, Immediate - 120.3-120.55

Economic release today -

- BOJ kept monetary policy unchanged.

- Eco watcher survey for March improved. Current condition moved to 52.2 from prior 50.1, outlook improved to 53.4 from 53.2 previous.

Commentary -

- Yen so far failed to stage comeback after BOJ policy hold.

- On other hand risk on environment keeping yen out of favor. Volatility remains low in the pair.

USD/CHF -

Trading at 0.964

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Sell Resistance

Support -

- Long term - 0.88, Medium term - 0.937, Short term - 0.945, Immediate - 0.954-0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.997, Immediate - 0.972-0.975

Economic release today -

- Consumer price index dropped -0.9% y/y in March but was positive 0.3% m/m.

Commentary -

- Franc is worst performer this week so far. Pair is lacking strong bias, however franc bulls seem to be retaining control for now.

- Pair is getting support around 0.96 area. Today's FOMC might guide the pair.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand