Dollar index trading at 94.34 (+0.19%).

Strength meter (today so far) - Euro -0.61%, Franc +0.02%, Yen +0.17%, GBP -0.13%

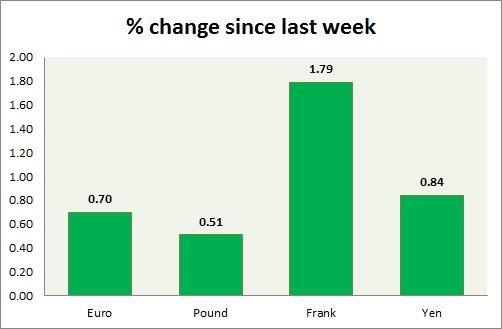

Strength meter (since last week) - Euro +0.70%, Franc +1.79%, Yen +0.84%, GBP +0.51%

EUR/USD -

Trading at 1.127

Trend meter -

- Long term - Sell, Medium term - Range/Buy Support, Short term - Buy

Support -

- Long term - 1.048-1.036, Medium term - 1.106-1.102, Short term - 1.11

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14

Economic release today -

- NIL

Commentary -

- Euro reached 1.139 in intraday trade and fell about 100 points from there driven by profit booking. Intraday volatility remains high. Focus now is on tomorrow's NFP report.

GBP/USD -

Trading at 1.522

Trend meter -

- Long term - Range/Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.462-1.455, Short term - 1.497- 1.494

Resistance -

- Long term - 1.553-1.56, Medium term - 1.553-1.56, Short term - 1.538, Immediate - 1.528-1.532

Economic release today -

- UK Election Day.

Commentary -

- Pound bulls are maintaining position heading into election. Election uncertainty seems to be priced in. Volatility might remain high over the coming trading days.

USD/JPY -

Trading at 119.2

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.5-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122. Immediate - 120.8

Economic release today -

- Japanese services PMI moved to expansionary zone at 51.3 for April.

Commentary -

- Yen is the top performer today, as risk aversion continue to provide support to Yen. Yen might do well amid UK election uncertainty.

USD/CHF -

Trading at 0.915

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.88, Medium term - 0.917-0.913, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987, Immediate - 0.944-0.047

Economic release today -

- Consumer climate for first quarter remained at same level of -6.

- Swiss foreign reserve dropped marginally from franc 522.3 billion to current 521.9 billion.

Commentary -

- Franc is best performer this week. Pair is facing some buying support at 0.90 psychological area. Further appreciation is possible, however key support area is coming close.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate