Dollar index trading at 94.9 (+0.3%).

Strength meter (today so far) - Euro -0.61%, Franc +0.02%, Yen +0.17%, GBP -0.13%

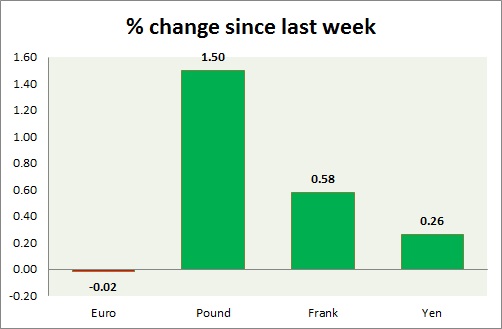

Strength meter (since last week) - Euro -0.02%, Franc +0.58%, Yen +0.26%, GBP +1.50%

EUR/USD -

Trading at 1.119

Trend meter -

- Long term - Sell, Medium term - Range/Buy Support, Short term - Range/Sell resistance

Support -

- Long term - 1.048-1.036, Medium term - 1.106-1.102, Short term - 1.11

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14

Economic release today -

- NIL

Commentary -

- Euro had a volatile week. Last night Euro dropped from 1.139 to 1.118 by today Asian hours, peaked around 1.127 post NFP, now trading around 1.12. Bud yield dropped and soured Euro rally. Further downside remains open, if bund yields drop further.

GBP/USD -

Trading at 1.536

Trend meter -

- Long term - Range/Sell, Medium term - Sell, Short term - Range/Buy support

Support -

- Long term - 1.425-1.417, Medium term - 1.462-1.455, Short term - 1.497- 1.494

Resistance -

- Long term - 1.553-1.56, Medium term - 1.553-1.56, Short term - 1.55

Economic release today -

- Conservative party won an outright majority, winning 330 sets so far. Labour party stand crushed at 232.

- Halifax house price index rose 1.6% m/m in April and 8.5% y/y.

- UK's trade deficit improved but still in negative territory at £ -2.82 billion.

Commentary -

- Pound turned out to be the performer as conservatives won the show. Focus would now shift towards monetary policy and economic dockets. However pound would keep riding positive vibe helping the bulls over the next week.

- However bulls were halted at 1.55 area. Pound is down about 170 points from high due selloffs post-election.

USD/JPY -

Trading at 119.9

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.5-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122. Immediate - 120.8

Economic release today -

- NIL

Commentary -

- Yen bulls lost grounds as global risk aversion faded. Pair got support around 119.

USD/CHF -

Trading at 0.927

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.88, Medium term - 0.917-0.913, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987, Immediate - 0.944-0.047

Economic release today -

- Unemployment rate edged up to 3.3% in April.

- Consumer price index dropped -0.2% m/m in April and -1.1% y/y.

Commentary -

- Franc dropped against dollar along Euro. Franc bulls might struggle from here as price moved very close to target area of 0.895. Profit bookings are suggested leaving small position open.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?