Dollar index trading at 93.93 (-0.66%).

Strength meter (today so far) - Euro +0.80%, Franc +0.64%, Yen +0.42%, GBP +0.09%

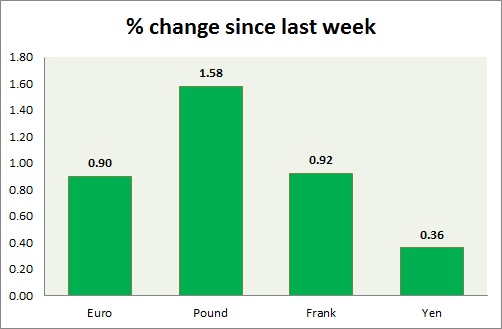

Strength meter (since last week) - Euro +0.90%, Franc +0.92%, Yen +0.36%, GBP +1.58%

EUR/USD -

Trading at 1.132

Trend meter -

- Long term - Sell, Medium term - Range/Buy Support, Short term - Range

Support -

- Long term - 1.048-1.036, Medium term - 1.106-1.102, Short term - 1.11

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14, Immediate - 1.129-1.132

Economic release today -

- Euro zone GDP rose 1% in first quarter from a year ago and 0.4% q/q

- Euro zone industrial production grew 1.8% in March from a year ago and dropped -0.3% m/m.

Commentary -

- Euro turned out to be the best performer after US retail sales disappointed to the downside. 1.132 area is providing some resistance as bund consolidate. Further rise is possible, however risk remains high.

GBP/USD -

Trading at 1.569

Trend meter -

- Long term - Range, Medium term - Buy Support, Short term - Range/Buy support

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.537-1.534

Resistance -

- Long term - 1.592-1.616, Medium term - 1.58-1.586, Short term - 1.582-1.584

Economic release today -

- UK unemployment rate dropped to 5.5% and wage growth beat estimate by growing 2.2% excluding bonus and 1.9% including it.

- BOE slashed growth forecast in latest quarterly inflation report.

- March inflation stands at zero percent.

Commentary -

- Pound rally soured around resistance area of 1.575 as Bank of England released downbeat inflation report. Further rise is still possible, however momentum is soured, suggesting buy support.

USD/JPY -

Trading at 119.3

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.5-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122. Immediate - 120.8

Economic release today -

- NIL

Commentary -

- Yen gained after retail sales report from US, gain was pretty sharp of around 50 pips. Overall yen would maintain its range.

USD/CHF -

Trading at 0.922

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.88, Medium term - 0.917-0.913, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987, Immediate - 0.944-0.947

Economic release today -

- NIL

Commentary -

- Franc performed due to weaker dollar suggesting franc bulls are losing strength, given lots of support area around 0.89-0.90.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?