Dollar index trading at 95.45 (+1.38%).

Strength meter (today so far) - Euro -1.75%, Franc -1.3%, Yen -0.64%, GBP -1.06%

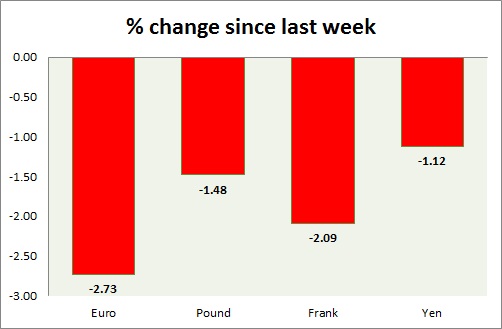

Strength meter (since last week) - Euro -2.73%, Franc -2.09%, Yen -1.12%, GBP -1.48%

EUR/USD -

Trading at 1.112

Trend meter -

- Long term - Sell, Medium term - Range/Buy Support, Short term - Range

Support -

- Long term - 1.048-1.036, Medium term - 1.106-1.102, Short term - 1.11

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.15

Economic release today -

- Euro zone consumer price remained flat in April with core prices growing at 0.6% y/y. Monthly CPI grew by 0.2%.

- Euro trade balance for April stands at € 23.4 billion.

- Zew survey showed economic sentiment deteriorated to 61.2.

Commentary -

- Euro lose heavily after ECB official indicated faster purchase during May and June. Better than expected home stats did the rest. Sell position is not recommended immediately amid heavy price swings.

GBP/USD -

Trading at 1.549

Trend meter -

- Long term - Range, Medium term - Buy Support, Short term - Range/Buy support

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.537-1.534, Immediate - 1.56-1.565

Resistance -

- Long term - 1.592-1.616, Medium term - 1.58-1.586, Short term - 1.582-1.584

Economic release today -

- UK CPI came negative at -0.1% for first time since 1960. Core consumer prices grew by 0.8% in April lower than previous 1%. PPI grew by 0.1% m/m. Retail price index grew by 0.4% in line with expectation. House price index rose 7.7% y/y.

Commentary -

- Pound dropped sharply amid weak inflation reading and strong dollar. 1.54 area provided support to pound.

USD/JPY -

Trading at 120.7

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Buy support/Sell resistance

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118.5-118

Resistance -

- Long term - 125, Medium term - 122, Short term - 122. Immediate - 120.8

Economic release today -

- Preliminary estimate of GDP to be released at 23:50 GMT.

Commentary -

- Pair is at key resistance, a break will clearly lead the way to further appreciation. Focus is on GDP data.

USD/CHF -

Trading at 0.938

Trend meter -

- Long term - Buy, Medium term - Sell/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.88, Medium term - 0.917-0.913, Short term - 0.90

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987, Immediate - 0.944-0.947

Economic release today -

- NIL

Commentary -

- Franc as expected lost further grounds to dollar. Buy is still not recommended. Resistance ahead might push the pair lower, which might be suitable position to buy.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary