Dollar index trading at 97.44 (+0.14%).

Strength meter (today so far) - Euro +0.06%, Franc +0.29%, Yen -0.42%%, GBP -0.45%

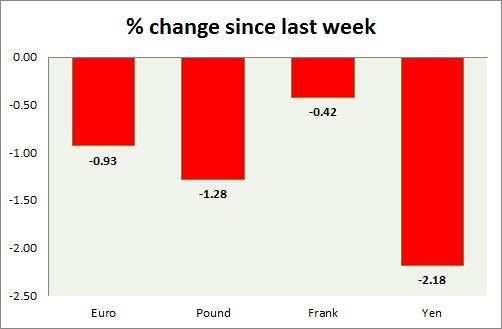

Strength meter (since last week) - Euro -0.93%, Franc -0.42%, Yen -2.18%, GBP -1.28%

EUR/USD -

Trading at 1.092

Trend meter -

- Long term - Sell, Medium term - Range/Sell, Short term - Range/Sell Resistance

Support -

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.065

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.12-1.123, Immediate - 1.103-1.105

Economic release today -

- Euro zone consumer confidence remained at same level in April at -5.5

- Services sentiment moved higher to 7.8 in April from 6.7 in March.

- Business climate deteriorated 0.28 from prior 0.33.

- Economic sentiment indicator remained flat at 103.8.

- Industrial confidence improved as expected to -3 from -3.2 prior.

Commentary -

- Euro consolidating near 1.09, since last night after Greek rumor of deal drafting appeared in media.

GBP/USD -

Trading at 1.528

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.537-1.534(broken)

Resistance -

- Long term - 1.592-1.616, Medium term - 1.58-1.586, Short term - 1.582-1.584, Immediate - 1.545

Economic release today -

- Second estimate showed first quarter GDP to rise 0.3% q/q and 2.4% from a year ago.

Commentary -

- Pound has broken below short term support area after bounce back in late Asian session. Further downside is likely.

USD/JPY -

Trading at 124.2

Trend meter -

- Long term - Buy, Medium term - Rang/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119, Immediate - 120.6

Resistance -

- Long term - 125, Medium term - 122 (broken), Short term - 122(broken).

Economic release today -

- Crucial CPI details along with unemployment stats are scheduled at 23:30 GMT, followed by industrial production at 23:50 GMT.

Commentary -

- Yen is again the worst performer today lost about 2% against dollar this week. Further loss is likely however 125 area is expected to provide support to yen.

USD/CHF -

Trading at 0.945

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy support

Support -

- Long term - 0.88, Medium term - 0.917-0.913, Short term - 0.90, Immediate - 0.925

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- UBS business consumption indicator dropped to 1.25 in April from 1.34 prior.

Commentary -

- Franc is giving some correction along with Euro and stands as the best performer this week so far. Expect buying at dips for the pair.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary