Dollar index trading at 100.57 (+0.21%)

Strength meter (today so far) – Euro +0.04%, Franc -0.06%, Yen +0.39%, GBP -0.00%

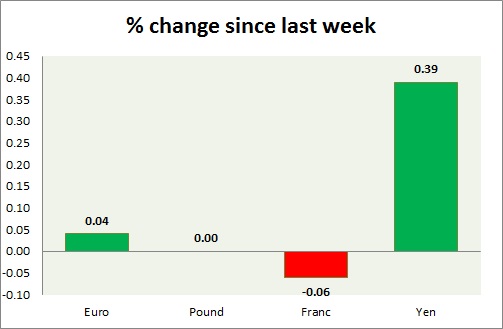

Strength meter (since last week) – Euro +0.04%, Franc -0.06%, Yen +0.39%, GBP -0.00%

EUR/USD –

Trading at 1.069

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.11, Medium term – 1.084, Short term – 1.084

Economic release today –

- Consumer sentiment improved to -4.7 in January.

- Services sentiment improved to 13.5 in January.

- Industrial confidence rose to 0.8

- Economic sentiment rose to 108.2

- Business climate came at 0.77

Commentary –

- The euro is trading flat against the dollar with lots of event risks scheduled for the week. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01. stop loss revised to 1.13

GBP/USD –

Trading at 1.254

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/buy

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.27

Economic release today –

- NIL

Commentary –

- The pound is flat against the dollar today. We expect the pound to reach parity.

USD/JPY –

Trading at 114.6

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – sell

Support –

- Long term – 98, Medium term – 105, Short term – 112

Resistance –

- Long term – 121, Medium term – 120, Short term – 119

Economic release today –

- Unemployment report for December will be released at 23:30 GMT, followed by industrial production numbers ta 23:50 GMT.

Commentary –

- The yen is the best performer today, but hasn’t been much of a performer for the past two weeks. Active call- Sell USD/JPY targeting 110.

USD/CHF –

Trading at 0.999

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/sell

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- KOF leading indicator declined to 101.7 in January from 102.2 in December.

Commentary –

- Franc is treading water around parity; it is the worst performer of the day, the pair is likely to decline towards 0.98 area in the very near term. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14