Dollar index trading at 101.92 (+0.10%)

Strength meter (today so far) – Euro -0.16%, Franc -0.01%, Yen -0.10%, GBP -0.33%

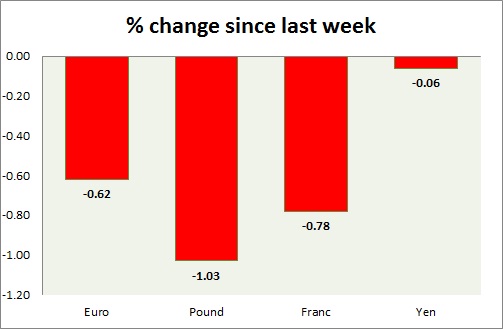

Strength meter (since last week) – Euro -0.62%, Franc -0.78%, Yen -0.06%, GBP -1.03%

EUR/USD –

Trading at 1.055

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.09, Medium term – 1.07, Short term – 1.07

Economic release today –

- NIL

Commentary –

- The euro consolidation is likely to continue unless the election uncertainties settle in the euro area. Dutch election is scheduled one week from now.

GBP/USD –

Trading at 1.216

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.25

Economic release today –

- UK spring budget speech will begin at 12:30 GMT.

Commentary –

- The pound is the worst performer of the week, heading to spring budget. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 114.1

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Range

Support –

- Long term – 107, Medium term – 109, Short term – 112

Resistance –

- Long term – 121, Medium term – 119, Short term – 115

Economic release today –

- Consumer price inflation is up 0.5 percent y/y in February.

Commentary –

- The yen is the best performer of the week but turned red against the dollar.

USD/CHF –

Trading at 1.013

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is worse performer than the euro this week. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX