Dollar index trading at 101.11 (-0.27%)

Strength meter (today so far) – Euro +0.04%, Franc +0.12%, Yen +0.02%, GBP +0.55%

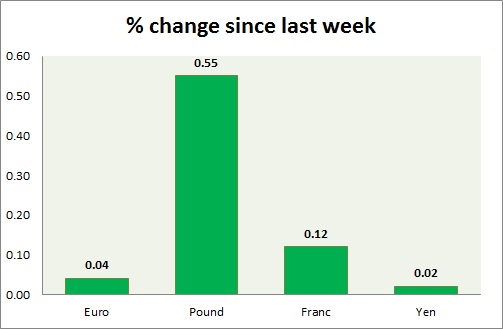

Strength meter (since last week) – Euro +0.04%, Franc +0.12%, Yen +0.02%, GBP +0.55%

EUR/USD –

Trading at 1.067

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.01, Medium term – 1.032, Short term – 1.032

Resistance –

- Long term – 1.09, Medium term – 1.07, Short term – 1.07

Economic release today –

- ECB President Draghi’s speech at 13:30 GMT.

Commentary –

- The focus for the euro is on the Dutch election on March 15th.

GBP/USD –

Trading at 1.222

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – range/sell

Support –

- Long term – 1.16, Medium term – 1.2, Short term – 1.2

Resistance –

- Long term – 1.32, Medium term – 1.27, Short term – 1.25

Economic release today –

- NIL

Commentary –

- The pound is focused on the upcoming Brexit bill voting in the House of Commons. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 114.6

Trend meter –

- Long term – Sell, Medium term – Range/ Buy, Short term – Range/Buy

Support –

- Long term – 107, Medium term – 109, Short term – 112

Resistance –

- Long term – 121, Medium term – 119, Short term – 115

Economic release today –

- Tertiary industry index flat for January.

Commentary –

- The yen breached the 115 support area last week but still hovering around as the dollar weakened across the board. Active call – Yen likely to reach 120 as key support broken.

USD/CHF –

Trading at 1.008

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- NIL

Commentary –

- Franc is up in line with the euro. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022