Dollar index trading at 97.57 (+0.43%).

Strength meter (today so far) - Euro -0.50%, Franc -0.18%, Yen -0.30%, GBP +0.10%

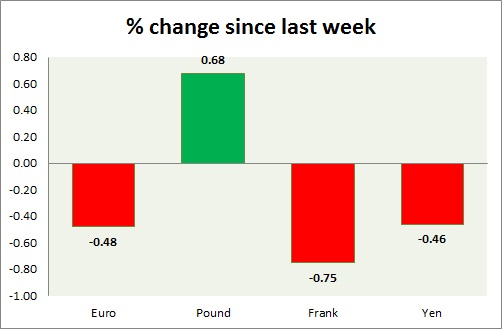

Strength meter (since last week) - Euro -0.48%, Franc -0.75%, Yen -0.46%, GBP +0.68%

EUR/USD -

Trading at 1.092

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- Euro zone business climate rose to 0.39, highest since March 2014.

- Economic sentiment index reached 104 from 103.5 prior.

- Services sentiment rose to 8.9 from 7.9 in June.

- Industrial confidence improved to -2.9 from -3.4 prior.

- Consumer confidence deteriorated to -7.1 from -5.6 prior.

Commentary -

- Euro is steadily falling after FOMC yesterday.

GBP/USD -

Trading at 1.561

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- GFK consumer confidence to be released at 23:00 GMT.

Commentary -

- Pound struggles to break free of 1.57 area, correction to the downside likely.

USD/JPY -

Trading at 124.3

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5. Immediate - 124.3

Economic release today -

- CPI scheduled at 23:30 GMT.

Commentary -

- Yen slide further after FOMC pushed dollar higher. Yen might lose to 127 against dollar if support around 121 holds.

USD/CHF -

Trading at 0.969

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- KOF leading indicator rose to 99.8 in July from 89.8 in June.

Commentary -

- The pair is likely to reach as high as 0.987 against dollar. Franc lost further ground today as FED is on path to hike rates.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate