Dollar index trading at 97.41 (-0.04%).

Strength meter (today so far) - Euro +0.09%, Franc -0.37%, Yen 0.00%, GBP +0.2%

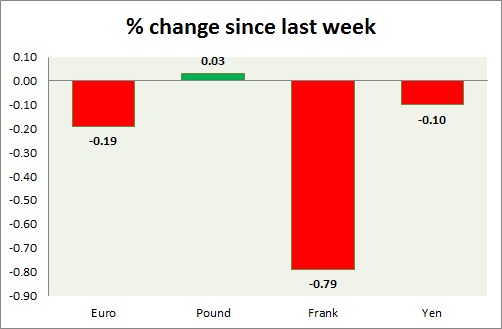

Strength meter (since last week) - Euro -0.19%, Franc -0.79%, Yen -0.10%, GBP +0.03%

EUR/USD -

Trading at 1.096

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- Euro Zone producer price index dropped -0.1% in June from May, down -2.2% on yearly basis.

Commentary -

- Euro is treading water just below 1.10 mark.

GBP/USD -

Trading at 1.562

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- July construction dropped to 57.1 from 58.1 prior.

Commentary -

- Pound continues to hover around 1.56 area with low volatility. 1.556 is proving to be strong support in the immediate term.

USD/JPY -

Trading at 124

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5. Immediate - 124.3-124.5

Economic release today -

- NIL

Commentary -

- Yen volatility dropped further. Focus is on NFP this week. Yen might lose to 127 against dollar if support around 121 holds.

USD/CHF -

Trading at 0.972

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- The pair might reach as high as 0.987 against dollar. Franc is the worst performing major today and this week. SNB is most likely selling Franc.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand