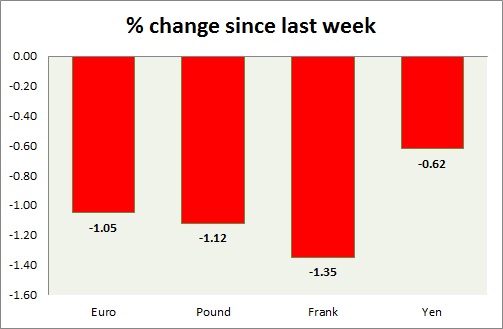

Dollar increased the bullish momentum against the majors (EUR, GBP, CHF, and JPY) further in today's trading. This week so far has been the dollar's. A chart and table is attached for explanation.

- Euro zone economies continued their improvement at varying scale. Today's services PMI data confirmed that. Euro zone's services PMI increased to 53.7 from previous 52.7. Retail sales data posted solid gains too at 3.7% YoY and 1.1% mom. Despite positive data Euro failed to keep its head high against dollar and further lost ground. Focus is on tomorrow's ECB. Euro is currently trading at 1.112. Immediate Support lies at 1.11 & Resistance 1.125.

- Pound is the star failure so far this week and broken below the resistance. Today services PMI released showed expansion but at a slower pace. PMI came at 56.7 compared to previous 57.2. Pound is currently trading at 1.5317. Immediate Support lies at 1.53, 1.52 & Resistance 1.545.

- Yen gained today over the arrival of risk aversion and official comments from officials in Japan. Yen is the top performer of the week so far. If the global sell off in equities continue Yen might see sharper rise. Yen is currently trading at 119.56. Immediate Support lies at 118.2 & Resistance 120.5.

- Franc finally getting some bids over risk aversion today, first time since January 2015, when SNB blinked on CHF floor. No major event risk scheduled for franc but Friday's CPI would be vital to assess the impact of the currency's revaluation this year. Currently trading at 0.961, still moving towards its target sub 0.98. Immediate Support lies at 0.939 & Resistance 0.975.

|

Euro |

-0.60% |

|

Pound |

-0.78% |

|

Frank |

-0.83% |

|

Yen |

0.07% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?