Dollar index trading at 96.13 (+0.07%)

Strength meter (today so far) – Euro -0.00%, Franc -0.26%, Yen -0.22%, GBP +0.24%

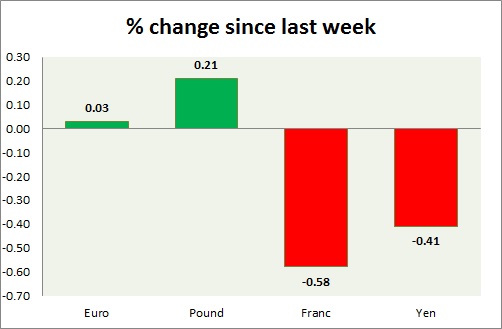

Strength meter (since last week) – Euro +0.03%, Franc -0.58%, Yen -0.41%, GBP +0.21%

EUR/USD –

Trading at 1.139

Trend meter –

- Long term – Range, Medium term – Buy, Short term – Range/ Buy

Support

- Long term – 1.05, Medium term – 1.08, Short term – 1.11

Resistance –

- Long term – 1.16, Medium term – 1.143, Short term – 1.143

Economic release today –

- NIL

Commentary –

- The Euro is up marginally this week so far. Active Call: Buy Euro targeting 1.16

GBP/USD –

Trading at 1.291

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Sell

Support –

- Long term – 1.21, Medium term – 1.24, Short term – 1.263

Resistance –

- Long term – 1.345, Medium term – 1.305, Short term – 1.305

Economic release today –

- NIL

Commentary –

- The pound is the best performer of the week but likely to remain under selling pressure as data continues to underwhelm. We remain bearish in the pound over a longer horizon.

USD/JPY –

Trading at 114.3

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 111

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2 (testing)

Economic release today –

- Flash report showed Machine tools orders are up 31.1 percent in June from a year ago.

Commentary –

- The yen remains weak on lack of risk aversion and monetary policy divergence.

USD/CHF –

Trading at 0.968

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.987

Economic release today –

- NIL

Commentary –

- Franc is the worst performer of the week on policy divergence.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022