Dollar index trading at 96.05 (+0.10%).

Strength meter (today so far) - Euro +0.31%, Franc -0.52%, Yen +0.37%, GBP -0.23%

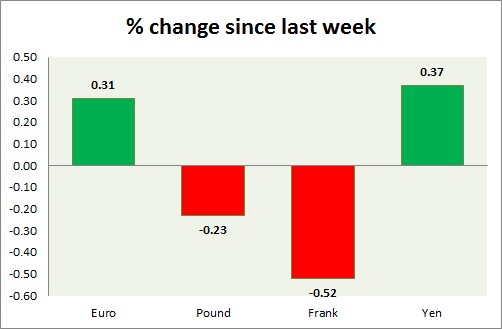

Strength meter (since last week) - Euro +0.31%, Franc -0.52%, Yen +0.37%, GBP -0.23%

EUR/USD -

Trading at 1.121

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.172, Short term - 1.163

Economic release today -

- Consumer price index rose by 0.2% in August from a year ago.

Commentary -

- Euro has reached initial target of 1.12 and now consolidating around that level.

GBP/USD -

Trading at 1.535

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.58

Economic release today -

- NIL

Commentary -

- Pound has broken below key support at 1.54 after it broke key trend line last week. Further decline is possible.

USD/JPY -

Trading at 121.2

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Sell

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 124.5

Economic release today -

- Housing starts rose by 7.4% from a year ago. Construction orders dropped by -4% in July.

Commentary -

- Yen failed to benefit much from today's selloffs in stocks.

USD/CHF -

Trading at 0.966

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- KOF leading indicator rose to 100.7 in August from 100.4 in July.

Commentary -

- Franc is the worst performer today and might drop further against Dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand