Dollar index trading at 93.13 (+0.36%)

Strength meter (today so far) – Euro -0.37%, Franc -0.59%, Yen -0.59%, GBP -0.49%

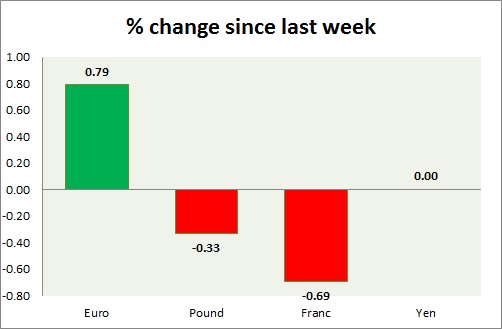

Strength meter (since last week) – Euro +0.79%, Franc -0.69%, Yen +0.00%, GBP -0.33%

EUR/USD –

Trading at 1.184

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Breakout/ Buy

Support

- Long term – 1.11, Medium term – 1.125, Short term – 1.14

Resistance –

- Long term – 1.20, Medium term – 1.18, Short term – 1.18

Economic release today –

- Markit services PMI came at 55.4

- Retail sales grew 0.5 percent in June, up 3.1 percent from a year ago.

Commentary –

- The euro retraced as the NFP report beats expectation. Active Call: Buy euro targeting 1.19

GBP/USD –

Trading at 1.308

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Sell

Support –

- Long term – 1.26, Medium term – 1.275, Short term – 1.293

Resistance –

- Long term – 1.345, Medium term – 1.32, Short term – 1.32

Economic release today –

- BoE kept policy rates unchanged at 25 basis points with 6-2 voting.

- Market services PMI improves to 53.8 in July.

Commentary –

- The pound is in decline on BoE dovishness and better than expected jobs report.

USD/JPY –

Trading at 110.6

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 110

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- NIL

Commentary –

- The yen is struggling around key resistance 110 area. Down over NFP report.

USD/CHF –

Trading at 0.974

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.987

Economic release today –

- NIL

Commentary –

- Franc remains a much weaker performer compared to the euro. The worst performer of the week. Active call – sell pair targeting 0.92

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX