Dollar index trading at 92.59 (+0.03%)

Strength meter (today so far) – Euro -0.26%, Franc -0.04%, Yen +0.04%, GBP +0.21%

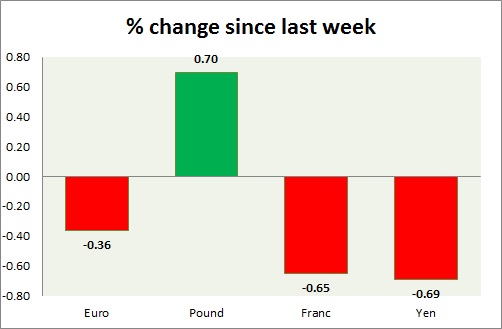

Strength meter (since last week) – Euro -0.36%, Franc -0.65%, Yen -0.69%, GBP +0.70%

EUR/USD –

Trading at 1.187

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Breakout/ Buy

Support

- Long term – 1.12, Medium term – 1.14, Short term – 1.16

Resistance –

- Long term – 1.22, Medium term – 1.19, Short term – 1.19 (testing)

Economic release today –

- Markit manufacturing PMI came at 57.4 in August.

Commentary –

- The euro gave up most of the gains despite a weaker jobs report.

GBP/USD –

Trading at 1.297

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Sell

Support –

- Long term – 1.26, Medium term – 1.275, Short term – 1.293

Resistance –

- Long term – 1.345, Medium term – 1.32, Short term – 1.32

Economic release today –

- Markit manufacturing PMI improves to 56.9 in August.

Commentary –

- The pound is the best performer of the week but struggling as it failed to clear key down trend line. Active call – Sell pound at 1.291 with target at 1.24

USD/JPY –

Trading at 110.1

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 107, Medium term – 108.4, Short term – 109

Resistance –

- Long term – 116, Medium term – 114.2, Short term – 114.2

Economic release today –

- Nikkei manufacturing PMI declines to 52.2 in August.

- Vehicle sales up 4.7 percent y/y in July.

- Consumer confidence index declines to 43.3 in August.

Commentary –

- The yen is down for the week so far as North Korea risk aversion fades. Active call – Buy yen targeting 101

USD/CHF –

Trading at 0.961

Trend meter –

- Long term – Buy, Medium term – Range/sell, Short term – Range/Sell

Support –

- Long term – 0.90, Medium term – 0.92, Short term – 0.95 (broken)

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.987

Economic release today –

- Real retail sales down 0.7 percent y/y in July

- PMI rose to 61.2 in August.

Commentary –

- Franc is much worse performer than the euro this week. Active call – sell pair targeting 0.92

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed