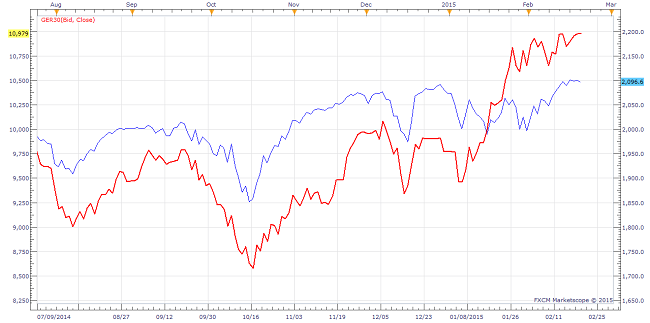

Over the past few years S&P 500 has enjoyed better returns against European counterparts in the backdrop of European financial crisis and financial stimulus from Federal Reserve.

- Two major events - European Central Bank (ECB) announced its own asset purchase programme. This open ended programme is going to start from March 2015. Federal Reserve zeroed its purchase and looking to hike rates.

- Even before the start of purchase by ECB, from the announcement and its anticipation, stock market dynamics have started changing, giving upper hand to European equities.

- This trend is expected to continue as the S&P 500 started lagging its German counterpart DAX since January 2015.

- It is also worth noting that many investors like famous billionaire George Sorrows moved out money from S&P 500 stocks to Europe.

- The bull trend in S&P 500 is not expected to falter but lag in the event of upcoming tightening, whereas other countries sought to ease.

Despite strong growth in the US economy, the domestic fuel advantage is reduced by lower oil price which in turn will help oil dependent economies as a whole. In such a case S&P 500 returns may lag that of Europe.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate