BofA Merrill Lynch notes:

As developed market rates stay elevated following the Q2 selloff, the macro arguments for both higher (better DM growth data, Greece resolution, approaching Fed hike) and lower yields (declining oil prices, stronger dollar, more aggressive ECB) have been well debated and established. However, a less advertised point is that we have now entered some of the strongest seasonal patterns in global fixed income markets, both in terms of market moves and issuance dynamics. We believe these could play a critical role (possibly more so than in prior years), and keeps us tactically bullish relative to consensus on long-end yields in USTs and Bunds.

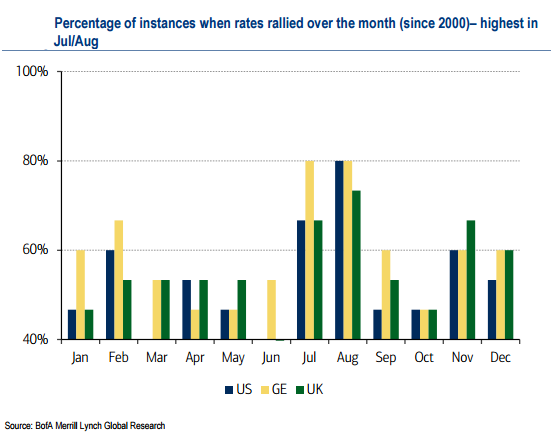

A look at seasonals across the US, Eurozone and the UK since 2000 indicate two clear results.

1) Bond yields are 20-25% more likely to rally in July and August than any other month in all three countries.

2) The magnitude of the rally is substantial - Bund yields decline on average by 10- 12bp in both July and August, while USTs and Gilts rally significantly more in August.

One intuitive explanation to this seasonal rally in government bond yields could be that it is an extension of the "Sell in May and go away" strategy in equities. However, we find little evidence to support this. While equity markets in these three countries are more likely to sell-off in June, there is little conclusive evidence on directionality in equity markets in July and August.

Instead, we believe the consistent summer rally is closely linked to seasonality of supply in fixed income markets. Note that net supply below refers to gross fixed coupon supply net of coupons, redemptions and central bank purchases.

- Net supply is consistently negative in July and August in the Eurozone. In fact, these two months have accounted on average for a 30% reduction in net issuance since 2009.

- In the US, net issuance over these two months although positive, combines for only 4% of the annual issuance.

- Digging deeper, a significant factor driving low net supply in these two months is high coupon payments. Nearly 25% of the annual coupon payments in both the US and the Eurozone are paid out in Jul-Aug. Arguably, coupon payments are more likely to be reinvested in similar duration assets than maturities.

- Working through the numbers also helps settle the old debate on what matters most for the direction of rates - gross vs. net issuance. Gross issuance in the Eurozone in July (when EZ rates rally the most) and in the US in August (when USTs rally the most) is about average (8% of yearly supply) making net numbers more relevant, albeit at least for these two months.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX