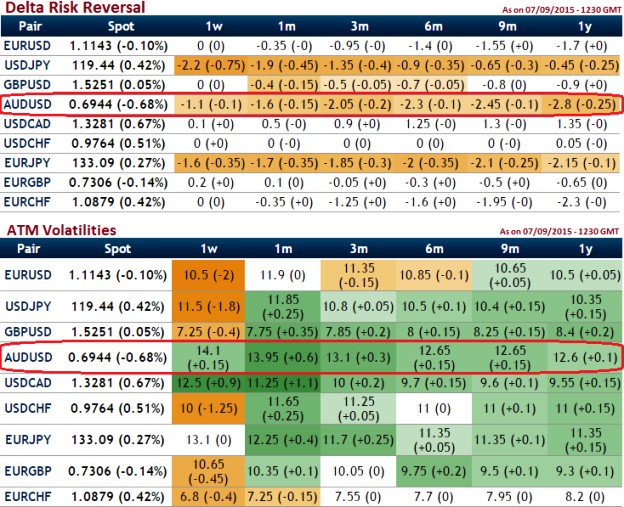

Volatility is better - AUDUSD is the highest volatile pair in next 3 months to 1 year (almost around 12-15%), the higher it is the higher the chances of big price movements. It means, theoretically, the market is expecting the price to move by 15%, either up or down, over certain time period. If AUD/USD is trading at 0.7030 and the IV of a 3M - 1Y option is 12.8, it means the market expects the price of AUD/USD to move either 12.8 above or below its current value in the next near future in a range from 0.6045 to 0.8014.

From the nutshells, for the next 1 year time frame, delta risk reversal is getting closer to -2 to -2.55. It is understood that ATM vols and 25-delta risk reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been over priced (downside protection is relatively more expensive).

Options with a higher IV cost more, this is intuitive due to the higher likelihood of the market swinging in your favour. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. A seller wants IV to fall so the premium falls. For an instance, setting up the below position has been quite difficult although it suggests healthy yields as short sides are risky venture.

Delta Risk Reversal and IV indicate continued AUD’s losing streak

Tuesday, September 8, 2015 6:48 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate