Arrest downside risks of USDJPY hedging through deploying option strategy: Put Ratio Back Spread

Expect the underlying currency cross (USDJPY in this case) to make a large move on the downside.

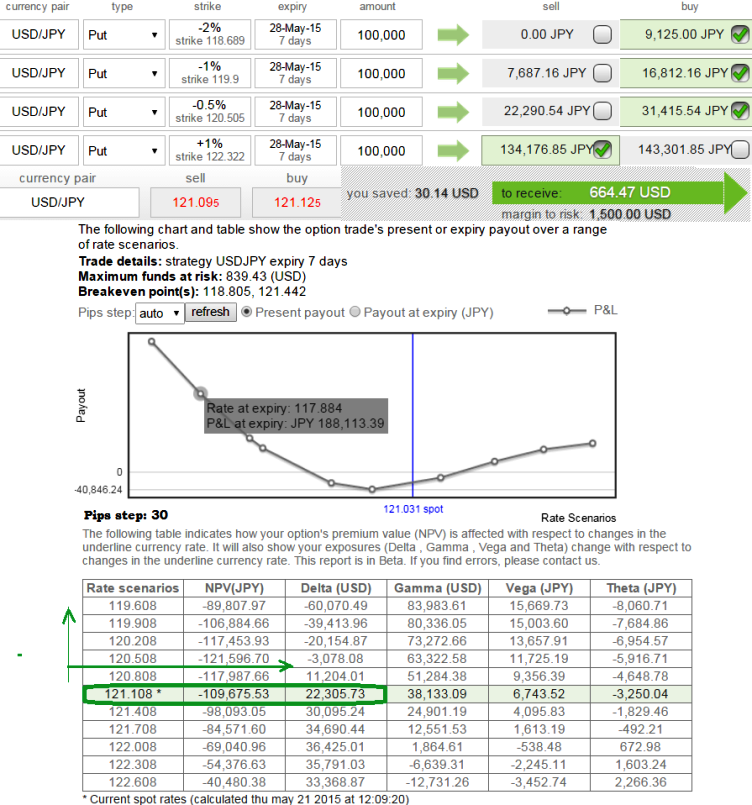

Purchase puts (OTM) and sell fewer puts of a higher strike (ATM or ITM) usually in a ratio of 2:1, 3:2 or 3:2.

This is more attractive and quite unusual strategy. Basically, you're selling an at-the-money short put spread in order to help pay for the extra out-of-the-money long put.

The higher strike short puts finances the purchase of the greater number of long puts and the position is entered for no cost or a net credit.

The underlying exchange rate has to make substantial move on the downside for the gains in long puts to overcome the losses in the short puts as the maximum loss is at the long strike.

Give it an adequate time to expiration so as to make a substantial move on the downside.

Delta advantage: As shown in the figure it is observed that the this strategy offers positive delta (22,305.73) at prevailing exchange rate which means we are long on USDJPY in underlying market. So, we are participating in dollar as long as it holds its strength but when JPY gains appreciation delta turns into negative (-3,078.08) which means we are also participating on downswings as well.

Delta advantage on Put Ratio Back Spread of USDJPY

Thursday, May 21, 2015 7:25 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings