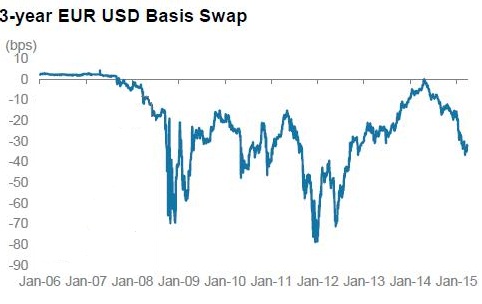

Chart attached shows 3 year EUR USD basis swap since 2006. Chart courtesy Sober look.

What is basis swap?

- Basis swap is an arrangement where two parties exchange variable interest rates from two different money market benchmark, like one might pay Libor where other might choose Treasury bill +spread.

- This given example is cross currency basis swap. Where one payment leg is Euro another is USD. Banks are the major participants in this arrangement.

Negative EUR USD basis swap means Euro zone banks are paying premium to access dollar funding. Extreme values might suggest stresses and funding crisis.

- This swap traded close to -70 basis points during 2008/09 as financial crisis of that time gave rise to liquidity crunch and banks run for liquidity have dollar pushed the basis spread to that level.

- During 2011/12, at peak of the Euro zone crisis, US money market funds withdrew their exposure to the region that gave rise to massive dollar funding lack, pushing the spread lower to around -80 basis points.

Since 2014, basis spread after reaching to zero, once again started dropping, now close to -30 basis points. Question is why? Is it an indication to renewed funding stress?

- Stress may not be the reason this time. US regulators penalties over banks has given to some dollar funding need, however that doesn't seem large enough to push the spread to the extent.

- Euro zone banks and investment house is reaching out to better yielding dollar assets is the major reason for this latest push.

Dollar will remain well bid, especially against Euro, Yen as yield spread is still significant. However, without improving yield that has fallen over weaker NFP and dovish FED Dollar will lack the driving force.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings