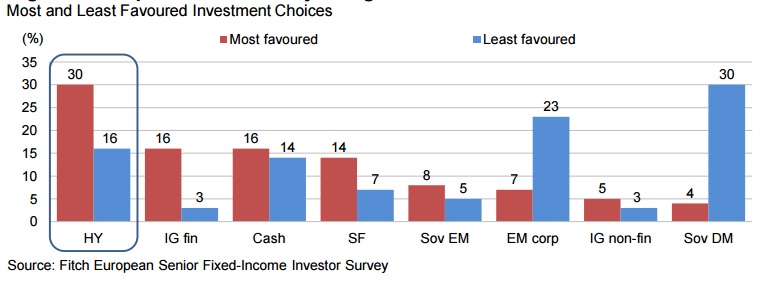

A survey by Fitch, shows some lights on which debt are in high demand these days and which are shunned. Preference by investors throws some light on expectations ahead and risk perception.

Key highlights -

- Emerging market corporates are vastly out of favor, as fear is high that with rate hike in US and UK looming, corporates will have tougher time to refinance their debt, big chunk of which is in foreign currency.

- 76% of the correspondents, view Brazil as greatest threat, followed by Russia (38%) and China (36%). Brazil is suffering from corruption scandal, slowdown in economy, commodity rout and fragile political scenario, where Russia's trouble is lower oil price and cost of geo-politics. China on other hand passing through tough time, balancing its economy and debt mountain, as well as a crash in its volatile stock market.

Their preferred debt indicate a shift in expectation and risk perception.

- Most favored asset class is high yield debt, favored by almost 30% investors, whereas 76% highlighted developed market sovereign debt as least preferred.

- This contrasting preference indicate that investors are more optimistic or less risk averse as they gobble up riskier high yield debt. It also indicates a rejection of sovereign safety at such low yields.

Some investors (16%) are preferring safety of cash amid global turmoil.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate