For some of the emerging market currencies, recent rout has been worst since financial crisis (2008/09), for some worst since Asian currency crisis (1997), for some worst since Taper Tantrum (2013) and for some, worst on record.

China's recent devaluation of Yuan just increased the pain of emerging market FX, which lost further grounds and fast since China's devaluation. Debasing Yuan just pulled an anchor for emerging market currencies, especially Asian ones.

Market participants are worried that China might be weaker than many had originally assumed, which is overall bad news for emerging markets. China consumes lot of exports of emerging market and with further slowdown in mainland, risks emerging markets.

Moreover, speculation has been going up for further devaluation from China, either controlled or uncontrolled.

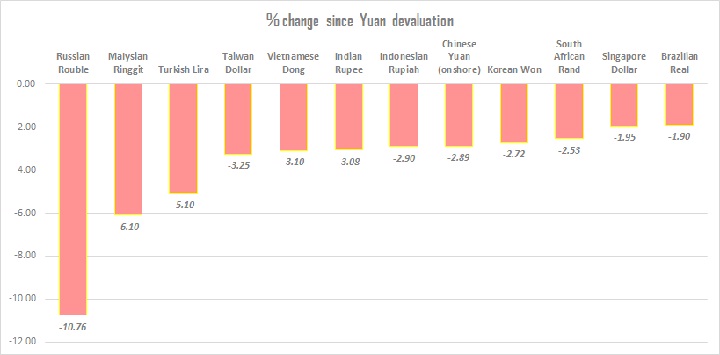

The chart represents some of the prominent emerging market's currencies since first devaluation of Yuan on August 11th. Drop would be larger if today's move is considered, data till Friday.

- Rouble is leading the way with-10.76% drop (oil price drop has contributed to the fall), followed by Malaysian Ringgit (-6.10%), Turkish Lira (-5.10%), Taiwan Dollar (-3.25%), Vietnamese Dong (-3.10%), Indian Rupee (-3.08%), Indonesian Rupiah (-2.90%), Korean Won (-2.72%), South African Rand (-2.53%), Singapore Dollar (-1.95%) and Brazilian Real (-1.9%).

Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight